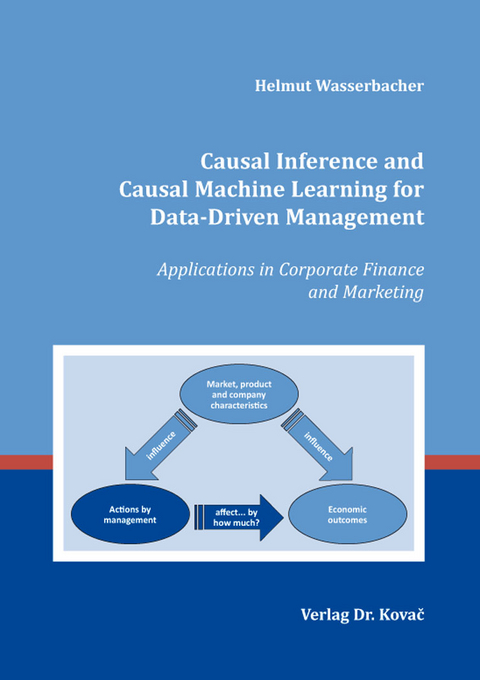

Causal Inference and Causal Machine Learning for Data-Driven Management

Applications in Corporate Finance and Marketing

Seiten

2024

|

1. Aufl.

Kovac, Dr. Verlag

978-3-339-13946-7 (ISBN)

Kovac, Dr. Verlag

978-3-339-13946-7 (ISBN)

The availability of large amounts of data, coupled with artificial intelligence and machine learning as suitable techniques to exploit them, has led to increasing interest in data-driven management. Data are turned into insights, and insights into management decisions.

In the midst of this passion for artificial intelligence, practitioners must remain aware that most machine learning methods maximize predictive performance. This is not the same as identifying causal patterns. Outside a valid causal framework, machine learning will lead to flawed conclusions about causal effects, and thus to incorrect decisions.

Data-driven management requires appropriate tools for causal questions. This book discusses in-depth three concrete examples in the areas of corporate finance and marketing.

In financial forecasting, planning and analysis (FP&A), machine learning appears well suited for the highly automated extraction of information form large amounts of data. However, FP&A practitioners need to distinguish between forecasting tasks and tasks related to planning and resource allocation. Off-the-shelf machine learning typically fails for causal inference and is not suited for planning and resource allocation.

In pharma marketing, the field force traditionally plays an important role. However, does a traditional field force still add value in an otherwise digital and virtual marketing mix? To answer this question, the impact of a field force within an omnichannel strategy is evaluated in a business experiment.

The third use case applies double machine learning to the capital structure puzzle and credit ratings. Double machine learning performs data-driven variable selection out of a large set of individual company characteristics and models their relationship with leverage and credit ratings without any strong assumption about the underlying functional form. This allows to quantify the causal effect of credit ratings, along the rating scale, on the leverage ratio.

In the midst of this passion for artificial intelligence, practitioners must remain aware that most machine learning methods maximize predictive performance. This is not the same as identifying causal patterns. Outside a valid causal framework, machine learning will lead to flawed conclusions about causal effects, and thus to incorrect decisions.

Data-driven management requires appropriate tools for causal questions. This book discusses in-depth three concrete examples in the areas of corporate finance and marketing.

In financial forecasting, planning and analysis (FP&A), machine learning appears well suited for the highly automated extraction of information form large amounts of data. However, FP&A practitioners need to distinguish between forecasting tasks and tasks related to planning and resource allocation. Off-the-shelf machine learning typically fails for causal inference and is not suited for planning and resource allocation.

In pharma marketing, the field force traditionally plays an important role. However, does a traditional field force still add value in an otherwise digital and virtual marketing mix? To answer this question, the impact of a field force within an omnichannel strategy is evaluated in a business experiment.

The third use case applies double machine learning to the capital structure puzzle and credit ratings. Double machine learning performs data-driven variable selection out of a large set of individual company characteristics and models their relationship with leverage and credit ratings without any strong assumption about the underlying functional form. This allows to quantify the causal effect of credit ratings, along the rating scale, on the leverage ratio.

| Erscheinungsdatum | 30.04.2024 |

|---|---|

| Reihe/Serie | Schriftenreihe Innovative Betriebswirtschaftliche Forschung und Praxis ; 578 |

| Verlagsort | Hamburg |

| Sprache | englisch |

| Maße | 148 x 210 mm |

| Gewicht | 467 g |

| Themenwelt | Wirtschaft ► Betriebswirtschaft / Management ► Marketing / Vertrieb |

| Schlagworte | Betriebswirtschaft • Causal machine learning • Digital Marketing • Kapitalstruktur • Künstliche Intelligenz • Marketing • Maschinelles Lernen • Omnichannel Marketing |

| ISBN-10 | 3-339-13946-6 / 3339139466 |

| ISBN-13 | 978-3-339-13946-7 / 9783339139467 |

| Zustand | Neuware |

| Haben Sie eine Frage zum Produkt? |

Mehr entdecken

aus dem Bereich

aus dem Bereich

Grundlagen marktorientierter Unternehmensführung : Konzepte, …

Buch (2024)

Springer Gabler (Verlag)

CHF 69,95

Aufgaben, Werkzeuge und Erfolgsfaktoren

Buch | Softcover (2023)

Vahlen (Verlag)

CHF 30,65

Digitale Geschäftsmodelle verstehen, designen, bewerten

Buch | Hardcover (2022)

Hanser (Verlag)

CHF 55,95