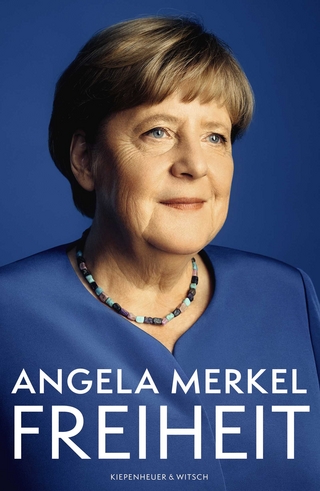

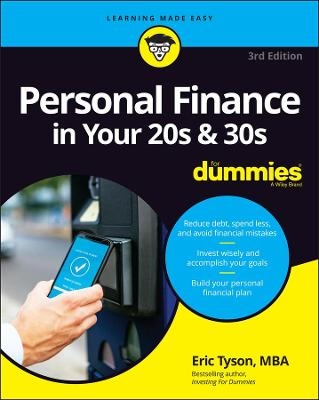

Personal Finance in Your 20s & 30s For Dummies

For Dummies (Verlag)

978-1-119-80543-4 (ISBN)

Personal Finance in Your 20s & 30s For Dummies helps Millennials and Zoomers like you make smart financial moves. It’s not as tough as it looks to reduce and file your taxes, pay off your student debt, buy a home, keep a budget to save and invest wisely, or start that side hustle, just to name a few. With a little bit of focus, you can start a clear path to financial freedom and avoid mistakes today. Your future self will thank you.

This edition is full of updates for the 2020s; wrap your mind around your investment opportunities, the realities of making a second income, higher ed options for career advancement, and lessons learned from the COVID-19 pandemic. If you’re in need of financial guidance—and who isn’t?—this is the book you need.

Pay off loans, manage your credit, begin the home-buying journey, and more

Set realistic money goals so you can create a solid path for financial success

Make smart decisions to beef up your bank account and investment portfolio

Protect the money you have today and learn how to put your money to work for the future

Get ready to turn up the volume on your financial know-how and stop worrying about money!

Eric Tyson, MBA, is a bestselling personal finance author, counselor, and writer. He is the author of the national bestselling financial books Investing For Dummies, Personal Finance For Dummies, and Home Buying Kit For Dummies.

Introduction 1

About This Book 1

Foolish Assumptions 2

Icons Used in This Book 3

Beyond the Book 3

Where to Go from Here 3

Part 1: Getting Started with Personal Finance 5

Chapter 1: Your Financial Checkup 7

Calculating Your Financial Worth 8

Defining net worth 8

Figuring what you own: Financial assets 8

Determining what you owe: Financial liabilities 9

Netting the difference 10

Grasping the Importance of Your Savings Rate 10

Calculating your income and outgo 11

Assessing the change in your net worth 11

Understanding and Improving Your Credit Score 13

Deciphering how lenders use credit reports and scores 13

Obtaining your credit reports and fixing errors 14

Getting your credit score 15

Improving your credit reports and score 15

Comprehending Your Investment Options 16

Examining Insurance Coverage 17

Identifying Common Financial Mistakes Young Adults Make 18

Chapter 2: Budgeting, Goal Setting, and Valuing Saving 21

Developing a Savings Mindset 22

What It’s Worth: Valuing Savings over Time 24

The power of continual savings 24

The rewards of earning a (slightly) higher annual return on your investment 25

Budgeting and Boosting Your Savings 26

Setting and Prioritizing Your Savings Goals 28

Identifying common goals of accomplished savers 28

Valuing retirement accounts and financial independence 29

Dealing with competing goals 30

Saving When You’re Strapped 31

Chapter 3: Using Loans and Paying Down Debts 33

Eyeing the Causes of Generational Debt 34

Making the Most of Loans 35

Dealing With Student-Loan Debt 36

Tracking your student loans and making timely payments 36

Prioritizing the payback of student loans 37

Using education tax breaks 38

Weighing the costs and benefits of education expenditures 39

Making the most of student loans, grants, and other financial aid 40

Benefits for military people 41

Paying Off Consumer Debt 41

Kicking the credit-card habit 42

Discovering debit cards: Convenience without credit temptation 42

Lowering the interest rate on consumer debt 44

Negotiating better rates from your current credit card 44

Tapping investments to reduce consumer debt 45

Paying down balances 45

Getting Help for Extreme Debt 46

Seeking counseling 46

Considering bankruptcy 47

Preventing Consumer Debt Relapses 50

Chapter 4: Everything Credit: Scores and Reports 51

A Primer on Credit Reports and Credit Scores 52

Differentiating between credit reports and credit scores 52

Understanding how credit scores are determined 53

Valuing of a good credit score 55

Jump-starting your credit score as a young adult 55

Getting Your Hands on Your Credit Reports and Scores 56

Recommended websites for free credit scores 57

Websites to avoid 57

Scrutinizing Your Credit Reports to Improve Them 58

Identifying errors and getting them fixed 58

Boosting your credit score 59

Preventing Identity Theft 60

Part 2: Saving and Earning More 65

Chapter 5: Proven Ways to Spend Less and Save More 67

Containing Housing Costs 68

Reducing rental costs 68

Slicing homeowner expenses 71

Cutting Your Taxes 72

Managing Food and Restaurant Spending 73

Trimming Transportation Expenses 75

Finessing Fashion Finances 76

Relaxing on a Budget 78

Taming Technology Spending 79

Keeping Down Insurance Costs 81

Getting Affordable and Quality Professional Advice 81

Handling Healthcare Expenses 82

Chapter 6: Taxes: Reduce Them When You Can! 83

Understanding Taxable Income 83

Comparing Marginal Taxes 84

Changes from the Tax Cut and Jobs Act Bill 86

Reducing Taxes on Work Income 87

Contributing to retirement plans 87

Using health savings accounts 89

Deducting self-employment expenses 90

Increasing Your Deductions 91

Lowering Investment Income Taxes 92

Investing in tax-free money market funds and bonds 92

Selecting other tax-friendly investments 92

Making your profits long term 93

Enlisting Education Tax Breaks 93

Preparing Your Tax Return and Minimizing Your Taxes 94

Chapter 7: Housing: Comparing Renting and Buying 97

The Ins and Outs of Renting 97

Seeing the benefits of renting 98

Considering the long-term costs of renting 98

Completing your rental application 99

Figuring the Costs of Owning and Making It Happen Financially 100

Deciding to buy 100

Comparing the costs of owning versus renting 101

Considering your overall financial health 103

Calculating how much you can borrow 104

Accumulating your down payment 104

Finding the Right Property 105

Working with Real-Estate Agents 108

Financing Your Home 109

Understanding your mortgage options 109

Deciding which mortgage type is best for you 109

Avoiding negative amortization and interest-only loans 110

Getting your mortgage approved 111

Putting Your Deal Together 112

Chapter 8: Relationships and Money 115

Handling Roommates 115

Living-Together Contracts 117

Getting Married 118

Understanding Your Money Beliefs and Practices 120

Examining your money history 121

Exploring your attitudes toward money 122

Understanding your friends and money 123

Making sense of your environment and money 124

Getting a Grip on Procrastination Where Money Is Concerned 124

Diagnosing procrastination 124

Coming to terms with why you may procrastinate with money issues 125

Overcoming money avoidance 127

Chapter 9: Making the Most of Your Career 131

Getting Your Career Going 131

Putting everything in order 132

Educating and training your way to career success 133

Seeking value for your education dollars 133

Investing in your career 138

Exploring Entrepreneurial Options 138

Starting a small business 138

Purchasing a small business 140

Investing in a small business 140

Changing Jobs or Careers 141

The Young and the Unemployed 142

Understanding how joblessness can hit younger adults harder 142

Accessing unemployment benefits 143

Taking action 143

Part 3: Investing for Your Future Goals 145

Chapter 10: Successful Investing Principles 147

Examining Bonds and Other Lending Investments 148

Investing in bonds 148

Considering the downsides to lending 149

Exploring Stocks, Real Estate, and Small-Business Investments 150

Socking your money away in stocks 150

Generating wealth with real estate 153

Going the small-business investment route 155

Considering Options, Cryptocurrencies, and Other Hot Vehicles 156

Opting for options 156

Calculating cryptocurrencies 157

Noting leveraged and inverse ETFs aren’t investments 158

Getting a Handle on Investment Risks 159

Establishing goals and risks 160

Comparing the risks of stocks and bonds 160

Spreading Your Investment Risks 161

Understanding why diversification is key 161

Allocating your assets 162

Holding onto your investments and shunning the herd 163

Selecting an Investment Firm 164

Evaluating Pundits and Experts 164

Chapter 11: Making the Best Use of Bank Accounts 167

Looking at Different Types of Banks 167

Brick-and-mortar banks 168

Online banks 168

Other choices 169

Understanding Your Bank Account Options 169

Transaction accounts 169

Options for getting cash 170

Savings accounts 171

Banking Online 171

Evaluating a bank: What to look for 171

Protecting yourself online 174

Considering Your Alternatives 175

Brokerage accounts with check writing 175

Money market funds 175

Chapter 12: Portfolios for a Purpose 177

Before You Begin Investing 177

Investing Nonretirement Account Money 178

Emergency money 178

Long-term money 179

Investing Retirement Account Money 182

Establishing and prioritizing retirement contributions 182

Allocating money in employer plans 183

Designating money in plans you design 185

Investing for Education 187

Understanding the importance of applying for financial aid 187

Paying for educational costs 190

Chapter 13: Real-Estate Investing 193

Understanding Real-Estate Investment Pros and Cons 193

Evaluating Simpler Real-Estate Investments 196

Assessing Residential Housing Investments 197

Investing in Commercial Real Estate 198

Shunning Sure-to-Lose Real-Estate Investments 199

Researching Where and What to Buy 201

Considering economic issues 201

Taking a look at the real-estate market 201

Examining property valuation and financial projections 203

Digging for a Good Deal 205

Part 4: Insurance: Protect Yourself, Your Loved Ones, and Your Assets 209

Chapter 14: Taking Care with Health Insurance 211

Making Sure You’re Covered 212

Transitioning your coverage 212

Seeing how Obamacare changed your coverage 213

Recent developments and likely future changes 214

Finding Your Best Health Plan 215

Selection of doctors and hospitals 216

Plan benefits and features 216

Shopping for Health Insurance 217

Uncovering the best policies 217

Dealing with Obamacare’s high health insurance prices 218

Handling insurance rejection 220

Health Savings Accounts: Tax Reduction for Healthcare Costs 221

Chapter 15: Safeguarding Your Income 223

Protecting Your Income for You and Yours: Disability Insurance 224

Understanding disability coverage you may already have 224

Determining how much disability insurance you need 225

Identifying useful disability policy features 226

Shopping for coverage 227

Protecting Your Income for Dependents: Life Insurance 227

Assessing your current life insurance coverage 228

Determining how much life insurance to buy 228

Deciding what type of life insurance to buy 229

Shopping for life insurance 231

Caring for Your Loved Ones: “Peace of Mind” Insurance 231

Chapter 16: Home, Auto, Renter’s, and Other Insurance Policies 233

Protecting Your Home and Possessions: Homeowner’s and Renter’s Insurance 234

Dwelling coverage 234

Personal property protection 235

Liability insurance 235

Renter’s insurance 236

Natural disaster protection 236

Shopping for homeowner’s insurance 237

Insuring Your Car 238

Liability protection 240

Collision and comprehensive 241

Riders you should bypass 241

Getting a good buy 242

Avoiding Policies That Cover Small Possible Losses 243

Extended warranty and repair plans 244

Home warranty plans 244

Dental insurance 244

Credit life and credit disability policies 245

Daily hospitalization insurance 245

Cell-phone insurance 245

Little stuff riders 246

Part 5: Your Information Diet 247

Chapter 17: Using Media Resources 249

Going Online: The Wild West of Advice and Predictions 250

Eyeing the real cost of “free” 250

Being aware online 252

Using the web for gathering information 252

Getting Financial Perspectives and Advice from the Media 254

Being a smart news consumer 255

Separating the best from the rest 256

Trusting unnamed “sources” is a bad idea 256

Understanding that political partisans are hazardous to your wealth 258

Chapter 18: Professionals You Hire 261

Seeing the Value of Professional Advice 261

Considering Financial Advisors 262

Preparing to hire a financial advisor 263

Finding good financial advisors 264

Interviewing advisors 264

Taming Your Taxes with Help 266

Working with Real-Estate Agents 267

Using Online Resources to Find Service Providers 269

Angi 270

HomeAdvisor 270

Other resources 271

Part 6: The Part of Tens 273

Chapter 19: Ten Ways to Save on a Car 275

Don’t Buy a Car in the First Place 276

Pay Cash: Shun Leasing and Borrowing 276

Consider Total Costs 277

Compare New with Used 277

Understand a Car’s Real Value Before Negotiating 277

Take Care of Your Car 278

Explore Your Servicing Options 278

Drive Safely 279

Take a Lean and Mean Insurance Policy 279

Track Tax-Deductible Auto Expenses 279

Chapter 20: Ten Things to Value More than Your Money 281

Investing in Your Health 281

Staying active and at a healthy weight 282

Using fitness trackers to monitor your activity level 282

Making and Keeping Friends 283

Appreciating What You Have 284

Minding Your Reputation 284

Continuing Education 285

Having Fun 285

Putting Your Family First 285

Knowing Your Neighbors 286

Volunteering and Donating 286

Caring for Kids 286

Chapter 21: Nearly Ten Things to Know about Apps 287

You May Well Get What You Paid for with “Free” Apps 288

Conduct and Manage Financial Tasks 288

Use Apps Only from Legitimate Companies with Lengthy Track Records 289

Consider the Alternatives to an App 289

Keep Focused on Your Spending 289

Settle up with Friends But Beware Fees 290

Save Money on Commonly Purchased Items 290

Tap into the Latest Economic and Financial Data 291

Invest with Confidence 292

Index 293

| Erscheinungsdatum | 02.07.2021 |

|---|---|

| Sprache | englisch |

| Maße | 183 x 231 mm |

| Gewicht | 408 g |

| Themenwelt | Wirtschaft ► Betriebswirtschaft / Management ► Personalwesen |

| ISBN-10 | 1-119-80543-0 / 1119805430 |

| ISBN-13 | 978-1-119-80543-4 / 9781119805434 |

| Zustand | Neuware |

| Informationen gemäß Produktsicherheitsverordnung (GPSR) | |

| Haben Sie eine Frage zum Produkt? |

aus dem Bereich