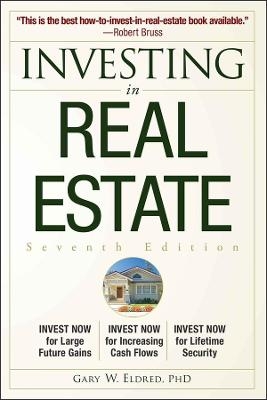

Investing in Real Estate

John Wiley & Sons Inc (Verlag)

978-1-118-17297-1 (ISBN)

The bestselling guide to real estate, newly revised for today’s investors

More than ever, investing in property today will set you on track to conquer financial uncertainty and build your long-term net worth. Investing in Real Estate, Seventh Edition offers dozens of experience- proven methods to convert these challenging times into the best of times.

Whether you want to fix and sell or buy, improve, and hold, market savvy real estate investor Gary W. Eldred shows you how to achieve your goals. He provides time-tested ways to grow a profitable portfolio and shows you how property investing can deliver twenty-two sources of financial return. You’ll learn how to negotiate like a pro, read market trends, and choose from multiple possibilities to finance your properties. This timely new edition also includes:

Historical context to emphasize how bargain prices and near record low interest rates now combine to offer unprecedented potential for short- and long-term profits

Successfully navigate and meet today’s loan underwriting standards

How to obtain discounted property prices from banks, underwater owners, and government agencies

How to value properties accurately—and, when necessary, intelligently challenge poorly prepared lender appraisals

Effective techniques to acquire REOs and short sales on favorable terms within reasonable time frames

How to market and manage your properties to outperform other investors

And much more!

Join the pros who are profiting from today’s market. All you need is the knowledge edge provided by Investing in Real Estate, Seventh Edition—the most favored and reliable guide to gaining the rewards that real estate offers.

GARY W. ELDRED, PhD is the bestselling author of The Beginner’s Guide to Real Estate Investing, The 106 Common Mistakes Homebuyers Make (and How to Avoid Them), Trump University Real Estate 101, and many others. He is a leading real estate authority whose Fortune 500 clients have included Wells Fargo, Georgia- Pacific, and Century 21. He frequently speaks at national investment conferences and has served on the graduate business faculty at Stanford University, the University of Illinois, and the University of Virginia.

Acknowledgments xix

Prologue: Invest in Property Now xxi

1 Achieve a Prosperous Future: 22 Ways You Can Earn Profits with Property 1

22 Sources of Profit from Investment Property 2

Will the Property Experience Price Gains from Appreciation? 2

Will You Gain Price Increases from Inflation? 4

Earn Good Returns from Cash Flows 5

Magnify Your Equity Gains with Leverage 5

Magnify Returns from Cash Flows with Leverage 6

Build Wealth through Mortgage Payoff 7

Over Time, Returns from Rents Go Up 7

Refinance to Lift Your Cash Flows 9

Refinance to Pocket Cash 10

Buy at a Below-Market Price 11

Sell at an Above-Market-Value Price 11

Create Property Value through Smarter Management 12

Create Value with a Savvy Market Strategy 12

Create Value: Improve the Location 13

Convert from Unit Rentals to Unit Ownership 13

Subdivide Your Bundle of Property Rights 14

Subdivide the Physical Property (or Space within a Property) 15

Create Plottage (or Assemblage) Value 16

Obtain Development or Redevelopment Rights 16

Diversify Away from Financial Assets 18

Is Property Your Best Investment Choice? 18

2 Opm: Borrow Smart, Raise Cash, Build Equity 21

The Birth of “Nothing Down” 22

Should You Invest with Little or No Cash or Credit? 23

What’s Wrong with “No Cash, No Credit, No Problem”? 23

Leverage: Pros and Cons 26

What Are Your Risk-Return Objectives? 32

Maximize Leverage with Owner-Occupancy Financing 33

Owner-Occupied Buying Strategies 34

Current Homeowners, Too, Can Use This Method 34

Why One Year? 34

Where Can You Find High-LTV Owner-Occupied Mortgages? 35

What Are the Loan Limits? 35

High Leverage for Investor-Owner Financing 37

High Leverage versus Low (or No) Down Payment 37

Creative Finance Revisited 37

Are High-Leverage Creative-Finance Purchases Readily Available? 45

Build Confi dence with Lenders, Investors, Sellers, and Sales Agents 46

Credit Scores and Credit Record 48

Capacity (Monthly Income) 48

Cash Reserves and Source of Down Payment 50

Collateral 51

Loan-to-Value Ratios 51

Recourse to Other Assets or Income 52

Character 53

Competence and Experience 54

Compensating Factors 54

Automated Underwriting (AUS) 55

3 Appraisal: Ins And Outs Of Market Value 57

What Is Market Value? 58

Sales Price Doesn’t Necessarily Equal Market Value 59

Underwriting Rules Determine the Value in LTV 59

How to Estimate Market Value 60

Property Description 61

Identify the Subject Property 68

Neighborhood 68

Site (Lot) Characteristics 69

Improvements 70

The Cost Approach 71

Calculate Cost to Build New 71

Deduct Depreciation 72

Lot Value 73

Estimate Market Value (Cost Approach) 73

The Comparable Sales Approach 75

Select Comparable Properties 75

Approximate Value Range—Subject Property 76

Adjust for Differences 76

Explain the Adjustments 77

The GRM Income Approach 78

Income Capitalization 80

Net Operating Income 80

Estimate Capitalization Rates (R) 83

Compare Cap Rates 84

Relative Prices: The Paradox of Risk and Appreciation (Depreciation) 85

Valuation Methods: Summing Up 86

Appraisal Limiting Conditions 87

Valuation versus Investment Analysis 87

4 Maximize Cash Flows and Grow Your Equity 89

Will the Property Yield Good Cash Flows? 89

Arrange Alternative Terms of Financing 91

Decrease (or Increase) Your Down Payment 92

Buy at a Bargain Price 94

Should You Ever Pay More than Market Value for a Property? 95

The Debt Coverage Ratio 97

Numbers Change, Principles Remain 97

Will the Property Yield Profi table Increases in Price? 98

Low-Involvement versus High-Involvement Investing 99

Compare Relative Prices of Neighborhoods (Cities) 100

Undervalued Neighborhoods and Cities 101

Beverly Hills versus Watts (South Central Los Angeles) 101

Demographics 103

Accessibility (Convenience) 103

Improved (Increased) Transportation Routes 104

Jobs and Economic Base 104

Taxes, Services, and Fiscal Solvency 105

New Construction, Renovation, and Remodeling 106

Land-Use Laws 106

Pride of Place 107

Sales and Rental Trends 107

Summing Up 109

5 Pay Less Than Market Value 111

Why Properties Sell for Less (or More) than Market Value 112

Owners in Distress 113

The Grass-Is-Greener Sellers 114

Stage-of-Life Sellers 115

Seller Ignorance 116

Prepare Screening Criteria 117

Bargain Sellers 118

Networking/Get the Word Out/Social Media 118

Newspapers and Other Publications 119

Cold Call Owners 119

Agent Services 121

Internet Listings 124

Seller Disclosures 124

The Disclosure Revolution 125

Income Properties 126

Summary 126

6 Profit with Foreclosures 127

The Foreclosure Process 128

Lender Tries to Resolve Problem 128

Filing Legal Notice 128

The Foreclosure Sale 129

REOs 129

Buy Preforeclosures from Distressed Owners 130

Approach Owners with Empathy 131

The Difficulties of Dealing Profitably with Owners in Default 131

Prequalify Homeowners and Properties 134

Finding Homeowners in Default (Prefiling) 135

Networking 135

Mortgage Collections Personnel 135

Drive Neighborhoods 136

Find Homeowners (Postfiling) 136

Cultivate a Relationship with Property Owners 137

Two More Issues 137

Vacant Houses 139

Satisfy Lenders and Lien Holders 140

All Parties Are Better Off 141

Win by Losing Less 142

Profi t from the Foreclosure Auction 142

Why Foreclosures Sell for Less than Market Value 143

Make the Adverse Sales Efforts Work for You 144

How to Arrange Financing 145

The Foreclosure Sale: Summing Up 146

7 Profit from Reos and other Bargain Sales 147

Sad for Sellers and Builders, Bargains for You 147

How to Find REOs 148

Follow Up with Lenders after Foreclosure Sales 148

Locate Specialty Realtors 149

HUD Homes and Other HUD Properties 150

Homeowners versus Investors 151

As-Is Condition 151

Potential Conflict of Interest 152

Buyer Incentives 153

The Bid Package 153

Department of Veterans Affairs (REOs) 153

Big Advantages for Investors 154

Fannie Mae and Freddie Mac REOs 155

Agent Listings 156

Investors Invited 156

Federal Government Auctions 157

Buy from Foreclosure Speculators 157

Probate and Estate Sales 158

Probate 158

Estate Sales 158

Private Auctions 159

How to Find Auctions 160

8 Profit by Creating Value 163

Fix, Sell, Profit! 163

Your Fixer-Upper Search 164

The Browns Create Value in a Down Market 165

Research, Research, Research 166

Improvement Possibilities 167

Deep Clean the Property 167

Add Pizzazz with Color Schemes, Decorating Patterns, and Fixtures 168

Create Usable Space 168

Create a View 169

Capitalize on Owner Nearsightedness 170

Eliminate a Negative View 170

Enhance the Unit’s Natural Light 171

Reduce Noise 171

Required Repairs and Improvements 172

Plumbing 172

Electrical System 172

Heating and Air Conditioning 173

Windows 173

Appliances 173

Walls and Ceilings 173

Doors and Locks 174

Landscaping 174

Storage Areas 174

Clean Well 174

Safety and Health 175

Roofs 175

Improvements and Alterations 175

You Can Improve Everything about a Property—Including Its Location 175

South Beach: From Derelicts to Fashion Models 176

Community Action and Community Spirit Make a Difference 177

Neighborhoods Offer Potential 177

What Types of Improvements Pay the Greatest Returns? 178

How Much Should You Budget for Improvements? 179

Beware of Overimprovement 179

Other Benefits 180

No-No Improvements? 180

Budgeting for Resale Profits 181

Estimate the Sales Price First 181

Estimate Costs 181

Future Sales Price – (Costs + Profi t) = Maximum Acquisition Price 182

Comply with Laws and Regulations 183

Should You Buy a Fixer-Upper? 184

Too Little Time? 184

Put Your Creativity to Work 185

9 More Techniques to Profit With Property 187

Lease Options 187

Here’s How Lease Options Work 188

Benefits to Tenant-Buyers (an Eager Market) 188

Benefits to Investor-Sellers 190

The Lease Option Sandwich 191

How to Find Lease Option Buyers and Sellers 192

A Creative Beginning with Lease Options (for Investors) 192

Lease Purchase Agreements 193

Seems More Defi nite 193

Amount of the Earnest Money (Option) Deposit 194

Contingency Clauses 194

Conversions 194

Condominium Conversion 195

Convert Apartments to Office Space 196

Tenants in Common 197

Master Leases 198

Assignments: Flipping Purchase Contracts 200

Summary 202

10 Negotiate a Win-Win Purchase Agreement 203

Win-Win Principles 204

The Purchase Contract 207

Names of the Parties 208

Site Description 208

Building Description 208

Personal Property 209

Price and Financing 210

Earnest Money Deposit 210

Quality of Title 211

Property Condition 212

Preclosing Property Damage (Casualty Clause) 212

Closing (Settlement) Costs 213

Closing and Possession Dates 214

Leases 214

Contingency Clauses 216

Assignment and Inspection 217

Public Records 217

Systems and Appliances 218

Environmental Hazards 218

No Representations 218

Default Clause 219

Summary 221

11 Strategic Management Builds Equity 225

The 10:1 Rule (More or Less) 225

Think First 226

Know Yourself 227

Know Your Finances 228

Know Your Capabilities 228

Smart Strategic Decisions 229

Tailor Strategy to Local Markets 229

Craig Wilson’s Profi t-Boosting Market Strategy 229

How Craig Wilson Used Market Information to Enhance Profitability 232

Results 236

Cut Operating Expenses 236

Energy Audits 237

Property Insurance 237

Maintenance and Repair Costs 240

Property Taxes and Income Taxes 241

Add Value: Closing Words 241

12 Develop the Best Lease 243

The Mythical Standard Lease 243

Your Market Strategy 243

Search for Competitive Advantage 245

Craft Your Rental Agreement 246

Names and Signatures 246

Joint and Several Liability 247

Guests 247

Length of Tenancy 247

Holdover Tenants (Mutual Agreement) 248

Holdover Tenants (without Permission) 248

Property Description 248

Inventory and Describe Personal Property 249

Rental Amounts 249

Late Fees and Discounts 250

Multiple Late Payments 250

Bounced Check Fees and Termination 250

Tenant “Improvements” 251

Owner Access 251

Quiet Enjoyment 251

Noxious Odors 252

Disturbing External Influences 252

Tenant Insurance 253

Sublet and Assignment 253

Pets 253

Security Deposits 254

Yard Care 255

Parking, Number, and Type of Vehicles 256

Repairs 256

Roaches, Fleas, Ants 257

Neat and Clean 257

Rules and Regulations 257

Wear and Tear 257

Lawful Use of Premises 258

Notice 258

Failure to Deliver 258

Utilities, Property Taxes, Association Fees 259

Liquid-Filled Furniture 259

Abandonment of Property 260

Nonwaivers 260

Breach of Lease (or House Rules) 260

No Representations (Full Agreement) 261

Arbitration 261

Attorney Fees (Who Pays?) 261

Written Notice to Remedy 263

Tenants’ Rights Laws 263

Tenant Selection 263

Property Operations 265

Evictions 265

Landlording: Pros and Cons 266

Possibilities, Not Probabilities 266

Professional Property Managers 266

13 Create Promotions That Sell 269

Design a Winning Value Proposition 269

Yet Generic Prevails 269

USP versus WVP 270

Craft Your Selling Message 272

Use a Grabber Headline or Lead 273

Reinforce and Elaborate 273

Add Hot Buttons 273

Establish Credibility 274

Compare to Substitutes 274

Evoke Emotional Appeal 274

Reduce Perceived Risks 274

Make It Easy for Prospects to Respond 275

Follow Up with Your Prospects 276

Reach Potential Buyers 277

For Sale Signs 277

Flyers and Brochures 277

Networking (Word of Mouth) 278

Websites and Links 279

Sales Agents 279

Should You Employ a Realty Agent? 279

Services to Sellers 279

Services to Buyers 280

Co-Op Sales 282

Listing Contracts 282

14 Pay Less Tax 285

The Risks of Change and Complexity 285

Homeowner Tax Savings 286

Capital Gains without Taxes 286

Rules for Vacation Homes 287

Mortgage Interest Deductions 288

Credit Card Interest 288

Rules for Your Home Offi ce 289

Depreciation Expense 289

Land Value Is Not Depreciable 289

Land Values Vary Widely 290

After-Tax Cash Flows 290

Passive Loss Rules 292

Taxpayers in the Real Property Business (No Passive Loss Rules) 292

Alternative Minimum Tax 293

Capital Gains 293

A Simplified Example 293

The Installment Sale 294

What’s the Bottom Line for Sellers? 295

Implications for Buyers 295

Tax-Free Exchanges 296

Exchanges Don’t Necessarily Involve Two-Way Trades 296

The Three-Party Exchange 296

Exchanges Are Complex but Easy 297

Are Tax-Free Exchanges Really Tax Free? 298

Section 1031 Exchange Rules 299

Reporting Rental Income and Deductions 300

Tax Credits 301

Complexity, Tax Returns, and Audits 303

Use a Tax Pro 305

Property Taxes 306

Summary 308

15 More Ideas for Profitable Investing 311

Out-of-Area Investing 312

Reasons to Invest Elsewhere 312

What about Property Management? 313

Tenant-Assisted Management 314

Property Management Companies 314

Emerging Growth Areas 314

The Creative Class 314

Implications for Investing in Real Estate 315

Right Place, Right Time 315

Emerging Retirement and Second-Home Areas 316

Which Cities and Areas? 316

Income Investing 317

Out-of-Area Caveats 317

Commercial Properties 318

Low Effort Management 319

The Upside and Downside 319

Opportunity for High Reward 320

Commercial Leases Create (or Destroy) Value 320

Triple Net (NNN) 322

Self-Storage 323

Mobile Home Parks 325

Profitable Possibilities with Zoning 327

Tax Liens and Tax Deeds 327

Localities Differ 328

Are Tax Liens and Tax Deeds an Easy Way to Make Big Profits? 328

Discounted Paper 328

What Is Discounted Paper? 329

Here’s How the Loan Sale Works 329

Sell the Note at a Premium 330

Delinquent and Nonperforming Loans 330

Due Diligence Issues 331

Should You Form an LLC? 332

Different Strokes for Different Folks 332

Court Rulings 332

One Size Doesn’t Fit All 332

16 Opportunity For A Lifetime 335

USA: Right Time, Right Price, Right Place 335

Personal Opportunity 336

Index 339

| Erscheint lt. Verlag | 13.4.2012 |

|---|---|

| Verlagsort | New York |

| Sprache | englisch |

| Maße | 150 x 226 mm |

| Gewicht | 454 g |

| Themenwelt | Wirtschaft ► Betriebswirtschaft / Management ► Finanzierung |

| Wirtschaft ► Betriebswirtschaft / Management ► Rechnungswesen / Bilanzen | |

| Betriebswirtschaft / Management ► Spezielle Betriebswirtschaftslehre ► Immobilienwirtschaft | |

| ISBN-10 | 1-118-17297-3 / 1118172973 |

| ISBN-13 | 978-1-118-17297-1 / 9781118172971 |

| Zustand | Neuware |

| Informationen gemäß Produktsicherheitsverordnung (GPSR) | |

| Haben Sie eine Frage zum Produkt? |

aus dem Bereich