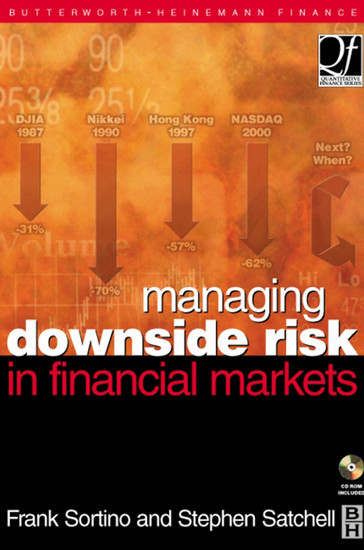

Managing Downside Risk in Financial Markets (eBook)

272 Seiten

Elsevier Science (Verlag)

978-0-08-049620-7 (ISBN)

'Downside Risk in Financial Markets' demonstrates how downside-risk can produce better results in performance measurement and asset allocation than variance modelling. Theory, as well as the practical issues involved in its implementation, is covered and the arguments put forward emphatically show the superiority of downside risk models to variance models in terms of risk measurement and decision making. Variance considers all uncertainty to be risky. Downside-risk only considers returns below that needed to accomplish the investor's goal, to be risky.

Risk is one of the biggest issues facing the financial markets today. 'Downside Risk in Financial Markets' outlines the major issues for Investment Managers and focuses on 'downside-risk' as a key activity in managing risk in investment/portfolio management. Managing risk is now THE paramount topic within the financial sector and recurring losses through the 1990s has shocked financial institutions into placing much greater emphasis on risk management and control.

Free Software Enclosed

To help you implement the knowledge you will gain from reading this book, a CD is enclosed that contains free software programs that were previously only available to institutional investors under special licensing agreement to The pension Research Institute. This is our contribution to the advancement of professionalism in portfolio management.

The Forsey-Sortino model is an executable program that:

1. Runs on any PC without the need of any additional software.

2. Uses the bootstrap procedure developed by Dr. Bradley Effron at Stanford University to uncover what could have happened, instead of relying only on what did happen in the past. This is the best procedure we know of for describing the nature of uncertainty in financial markets.

3. Fits a three parameter lognormal distribution to the bootstrapped data to allow downside risk to be calculated from a continuous distribution. This improves the efficacy of the downside risk estimates.

4. Calculates upside potential and downside risk from monthly returns on any portfolio manager.

5. Calculates upside potential and downside risk from any user defined distribution.

Forsey-Sortino Source Code:

1. The source code, written in Visual Basic 5.0, is provided for institutional investors who want to add these calculations to their existing financial services.

2. No royalties are required for this source code, providing institutions inform clients of the source of these calculations. A growing number of services are now calculating downside risk in a manner that we are not comfortable with. Therefore, we want investors to know when downside risk and upside potential are calculated in accordance with the methodology described in this book.

Riddles Spreadsheet:

1. Neil Riddles, former Senior Vice President and Director of Performance Analysis at Templeton Global Advisors, now COO at Hansberger Global Advisors Inc., offers a free spreadsheet in excel format.

2. The spreadsheet calculates downside risk and upside potential relative to the returns on an index

Brings together a range of relevant material, not currently available in a single volume source

Provides practical information on how financial organisations can use downside risk techniques and technological developments to effectively manage risk in their portfolio management

Provides a rigorous theoretical underpinning for the use of downside risk techniques. This is important for the long-run acceptance of the methodology, since such arguments justify consultant's recommendations to pension funds and other plan sponsors

Quantitative methods have revolutionized the area of trading, regulation, risk management, portfolio construction, asset pricing and treasury activities, and governmental activity such as central banking to name but some of the applications. Downside-risk, as a quantitative method, is an accurate measurement of investment risk, because it captures the risk of not accomplishing the investor's goal.'Downside Risk in Financial Markets' demonstrates how downside-risk can produce better results in performance measurement and asset allocation than variance modelling. Theory, as well as the practical issues involved in its implementation, is covered and the arguments put forward emphatically show the superiority of downside risk models to variance models in terms of risk measurement and decision making. Variance considers all uncertainty to be risky. Downside-risk only considers returns below that needed to accomplish the investor's goal, to be risky.Risk is one of the biggest issues facing the financial markets today. 'Downside Risk in Financial Markets' outlines the major issues for Investment Managers and focuses on "e;downside-risk"e; as a key activity in managing risk in investment/portfolio management. Managing risk is now THE paramount topic within the financial sector and recurring losses through the 1990s has shocked financial institutions into placing much greater emphasis on risk management and control.Free Software Enclosed To help you implement the knowledge you will gain from reading this book, a CD is enclosed that contains free software programs that were previously only available to institutional investors under special licensing agreement to The pension Research Institute. This is our contribution to the advancement of professionalism in portfolio management.The Forsey-Sortino model is an executable program that:1. Runs on any PC without the need of any additional software.2. Uses the bootstrap procedure developed by Dr. Bradley Effron at Stanford University to uncover what could have happened, instead of relying only on what did happen in the past. This is the best procedure we know of for describing the nature of uncertainty in financial markets. 3. Fits a three parameter lognormal distribution to the bootstrapped data to allow downside risk to be calculated from a continuous distribution. This improves the efficacy of the downside risk estimates.4. Calculates upside potential and downside risk from monthly returns on any portfolio manager. 5. Calculates upside potential and downside risk from any user defined distribution.Forsey-Sortino Source Code:1. The source code, written in Visual Basic 5.0, is provided for institutional investors who want to add these calculations to their existing financial services. 2. No royalties are required for this source code, providing institutions inform clients of the source of these calculations. A growing number of services are now calculating downside risk in a manner that we are not comfortable with. Therefore, we want investors to know when downside risk and upside potential are calculated in accordance with the methodology described in this book. Riddles Spreadsheet:1. Neil Riddles, former Senior Vice President and Director of Performance Analysis at Templeton Global Advisors, now COO at Hansberger Global Advisors Inc., offers a free spreadsheet in excel format.2. The spreadsheet calculates downside risk and upside potential relative to the returns on an index

| Erscheint lt. Verlag | 20.9.2001 |

|---|---|

| Sprache | englisch |

| Themenwelt | Recht / Steuern ► Wirtschaftsrecht |

| Wirtschaft ► Betriebswirtschaft / Management ► Finanzierung | |

| Betriebswirtschaft / Management ► Spezielle Betriebswirtschaftslehre ► Bankbetriebslehre | |

| Wirtschaft ► Betriebswirtschaft / Management ► Unternehmensführung / Management | |

| ISBN-10 | 0-08-049620-2 / 0080496202 |

| ISBN-13 | 978-0-08-049620-7 / 9780080496207 |

| Haben Sie eine Frage zum Produkt? |

Kopierschutz: Adobe-DRM

Adobe-DRM ist ein Kopierschutz, der das eBook vor Mißbrauch schützen soll. Dabei wird das eBook bereits beim Download auf Ihre persönliche Adobe-ID autorisiert. Lesen können Sie das eBook dann nur auf den Geräten, welche ebenfalls auf Ihre Adobe-ID registriert sind.

Details zum Adobe-DRM

Dateiformat: PDF (Portable Document Format)

Mit einem festen Seitenlayout eignet sich die PDF besonders für Fachbücher mit Spalten, Tabellen und Abbildungen. Eine PDF kann auf fast allen Geräten angezeigt werden, ist aber für kleine Displays (Smartphone, eReader) nur eingeschränkt geeignet.

Systemvoraussetzungen:

PC/Mac: Mit einem PC oder Mac können Sie dieses eBook lesen. Sie benötigen eine

eReader: Dieses eBook kann mit (fast) allen eBook-Readern gelesen werden. Mit dem amazon-Kindle ist es aber nicht kompatibel.

Smartphone/Tablet: Egal ob Apple oder Android, dieses eBook können Sie lesen. Sie benötigen eine

Geräteliste und zusätzliche Hinweise

Buying eBooks from abroad

For tax law reasons we can sell eBooks just within Germany and Switzerland. Regrettably we cannot fulfill eBook-orders from other countries.

aus dem Bereich