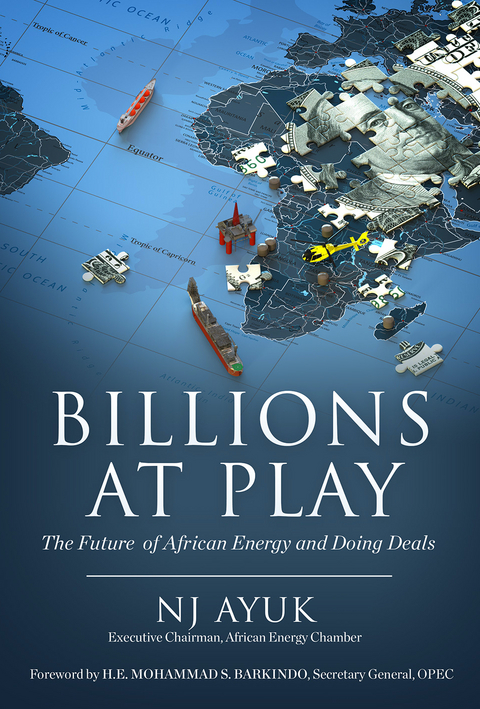

Billions at Play (eBook)

100 Seiten

Made for Success Publishing (Verlag)

978-1-64146-561-8 (ISBN)

1

It’s High Time for African Oil and Gas to Fuel a Better Future for Africans

IN APRIL 2020, THE ATMOSPHERE in northern Colorado was tense. Yes, the COVID-19 pandemic certainly was part of it. But in an area known for its prolific oil and gas industry, there also were concerns about the petroleum industry downturn. Rigs were sitting idle. Oil and gas people were being laid off.

I am not trying to minimize anyone’s difficulties, but from a big-picture perspective, there also was—and still is—a glimmer of hope. Communities throughout northern Colorado have built strong economies and diversified over time, putting them in a better position to weather the current storm.

In fact, northern Colorado is an outstanding picture of oil and gas supporting economic growth, job creation, and increased opportunities. In Aurora, Colorado, for instance, revenue and economic activity generated by the petroleum industry made it possible to develop the nearby Colorado Air and Space Port and Gaylord Rockies Resort & Convention Center, among other projects.

I realize that COVID-19 is impacting the world economy, and, as I said, this is still a difficult time for northern Colorado. But the economic diversification there, rooted in the area’s petroleum industry, will likely play a huge role in minimizing economic damage and easing recovery after the pandemic.

When I completed the first edition of this book in 2019, I asked why oil and gas success stories should be limited to the United States. “It’s time to see the same results in African communities,” I wrote. I stand behind those words, but now, with the world facing major health and economic crises, I have something to add: Why shouldn’t African countries benefit from the kind of resiliency and diversification we’re seeing in northern Colorado and other U.S. communities? The answer to both questions is the same: There is no good reason why Africa can’t achieve the same things. And our oil and gas resources can help us get there. They can help us recover more quickly from tough times and lay the foundation for prosperity and a better quality of life during times of growth.

To some degree, it has already started.

One promising example is happening about an hour east of Lagos, Nigeria, where the construction site of a $12 billion oil refinery and petrochemical plant has become a multicultural hub of sorts.1 More than 7,000 workers from Nigeria, India, and other countries have worked on this project, and the refinery is expected to go online in early 2021.

The man behind this project, Nigerian business magnate Aliko Dangote, predicts that once complete, the refinery will process 650,000 bbl/d and create thousands of jobs. Already, 900 Nigerian engineers are being trained in India for permanent positions at the refinery, and even more jobs will be created when Dangote’s multinational industrial conglomerate, Dangote Group, moves forward with plans to build a port, jetty, power plants, and roads there.

If everything comes together as planned, the refinery complex has great potential to diversify and strengthen Nigeria’s economy, spur knowledge and technology transfers, attract lucrative foreign investment opportunities, and put an end to Nigeria’s dependency on petroleum exports.2

It’s an audacious project and a powerful example of the oil and gas (O&G) industry’s power to create a brighter future for Africa. And it’s one of many promising O&G-related developments taking place across the continent.

As of this writing:

-

The Alen Monetization Project offshore Equatorial Guinea, which will ensure stable gas supply to Equatorial Guinea’s liquid natural gas (LNG) and downstream revenue-generating infrastructure, is on track to start in 2021. The project was launched by Noble Energy and has since been purchased by U.S. oil and gas multinational, Chevron Corporation, which has been successfully leading natural gas commercialization efforts in Nigeria for decades. Chevron also operates the world’s largest liquid petroleum gas (LPG) floating production storage and offloading (FPSO) vessel in Angola, which turns previously flared gas into cleaner fuels.

-

Somalia opened its first-ever licensing round in August 2020 for up to seven exploration blocks. “COVID-19 will not last forever,” Somali Petroleum Authority Chairman and CEO Ibrahim Ali Hussein said. “Oil companies will be budgeting for Somali exploration.”

-

Democratic Republic of Congo President Félix Antoine Tshisekedi has asked government officials to fast-track legal processes and permits that will allow the valorization of natural gas produced onshore by European oil and gas company, Perenco. This move will open the door to investments in gas monetization and facilitate much-needed gas-to-power initiatives.

-

The DeepSea Stavanger oil and gas drill rig recently arrived in Cape Town, South Africa, to drill the Luiperd prospect in Block 11B/12B off the Mossel Bay coast, Western Cape for Total SA and its partners. “The arrival of the drill rig, following the recent successful Brulpadda discovery, reaffirms confidence in South Africa as an investment destination of choice for the exploration of oil and gas,” Minister of Mineral Resources and Energy Gwede Mantashe said. “This is despite the negative impact of the COVID-19 pandemic on economies around the world.”

-

At least 68 U.S. companies have agreed to supply equipment and services for engineering, procurement, and construction of a $23-billion two-train liquefied natural gas (LNG) processing plant project in Mozambique. The Mozambique Area 1 LNG Project, owned by Total Exploration and Production, is expected to develop an initial 18 trillion cubic feet of natural gas by 2024.

-

The Lake Albert Development Project is moving forward again now that Uganda’s government and investment partners Total, Tullow Oil, and China National Offshore Oil Corporation have resolved a long-standing capital gains tax dispute. The project includes exploration and production activities along with the construction of the 1,443-kilometer East Africa Crude Oil Pipeline beginning in 2021 and an oil refinery. The two oilfields on the shores of Lake Albert contain approximately six billion barrels of oil.

Despite these achievements, I’ve heard the nay-sayers enough to know how they’ll respond to so much “good news”: You are being overly optimistic. What about the petroleum downturn and the pandemic?

My response would be, first, that volatility has been a reality in the oil and gas industry from its earliest days, so the current low prices aren’t something that hasn’t been lived through before. Downturns do not negate petroleum resources’ value to Africans. As for the pandemic: There is no question that it is a horrific global disaster and tragedy. But it will not be permanent.

Meanwhile, we still have reasons to be hopeful about Africa’s petroleum industry. As executive chairman of the African Energy Chamber, I’ve found that increasing numbers of governments have been open to working with the chamber during this time, and so have companies. That opens the door to dialogue and joint efforts to find common solutions. The chamber also has released specific measures that we believe will help Africa’s oil and gas industry recover from the pandemic. They are included in this book.

I’m familiar with arguments made before the pandemic as well: Oil and gas have yet to solve Africa’s problems, and in fact, only causes more problems. What about Africa’s corruption and political instability? What about the lack of infrastructure?

But it is high time to leave this unproductive negativity in the past.

It’s quite easy for someone to say Africans don’t fit the mold of oil and gas entrepreneurs—we have proven that we just have to break the mold and fight for an oil industry that works for every African. We’re all familiar with Africa’s challenges, and we’re aware of Africa’s perceived resource curse. Too often, our natural resources create wealth for foreign investors and a select group of African elites. At the same time, everyday people fail to benefit or—even worse—suffer the effects: instability, conflict, and environmental damage.

But this is what everyone refuses to talk about—that the curse is reversible. If African governments, businesses, and organizations manage Africa’s oil and gas revenues wisely, we can make meaningful changes across the continent. We can replace instability with good governance, economic growth, and better opportunities for everyday Africans. Oil can work for everybody. It can create positive outcomes, and it can transition economies. We all have an obligation to support reliable companies that are investing and doing good work, encourage those that are timid, and warn those who still think business must be done like in the good old days.

I’m not being idealistic. You can find plenty of examples of natural resources contributing to meaningful changes for the better, both in Africa and in other parts of the world.

The following are two of my favorite recent examples.

Capitalizing on Copper in Chile

Chile is one of the largest copper producers in the world: It controls more than 20 percent of the world’s copper reserves and is responsible for 11 percent of the total global production. And, in June 2017, a delegation of Chilean government leaders and business representatives arrived in Addis Ababa, the capital of Ethiopia, with an invaluable gift. They came to tell African leaders how their...

| Erscheint lt. Verlag | 12.1.2021 |

|---|---|

| Vorwort | Mohammad Sanusi Barkindo |

| Sprache | englisch |

| Themenwelt | Technik ► Elektrotechnik / Energietechnik |

| Wirtschaft ► Betriebswirtschaft / Management ► Unternehmensführung / Management | |

| Schlagworte | oil industry, African Oil Industry, OPEC, Oil policy, natural resource extraction, Energy Policy, Foreign Energy crisis |

| ISBN-10 | 1-64146-561-1 / 1641465611 |

| ISBN-13 | 978-1-64146-561-8 / 9781641465618 |

| Informationen gemäß Produktsicherheitsverordnung (GPSR) | |

| Haben Sie eine Frage zum Produkt? |

Größe: 1,1 MB

DRM: Digitales Wasserzeichen

Dieses eBook enthält ein digitales Wasserzeichen und ist damit für Sie personalisiert. Bei einer missbräuchlichen Weitergabe des eBooks an Dritte ist eine Rückverfolgung an die Quelle möglich.

Dateiformat: EPUB (Electronic Publication)

EPUB ist ein offener Standard für eBooks und eignet sich besonders zur Darstellung von Belletristik und Sachbüchern. Der Fließtext wird dynamisch an die Display- und Schriftgröße angepasst. Auch für mobile Lesegeräte ist EPUB daher gut geeignet.

Systemvoraussetzungen:

PC/Mac: Mit einem PC oder Mac können Sie dieses eBook lesen. Sie benötigen dafür die kostenlose Software Adobe Digital Editions.

eReader: Dieses eBook kann mit (fast) allen eBook-Readern gelesen werden. Mit dem amazon-Kindle ist es aber nicht kompatibel.

Smartphone/Tablet: Egal ob Apple oder Android, dieses eBook können Sie lesen. Sie benötigen dafür eine kostenlose App.

Geräteliste und zusätzliche Hinweise

Buying eBooks from abroad

For tax law reasons we can sell eBooks just within Germany and Switzerland. Regrettably we cannot fulfill eBook-orders from other countries.

aus dem Bereich