Rethinking Taxation in Latin America

Springer International Publishing (Verlag)

978-3-319-60118-2 (ISBN)

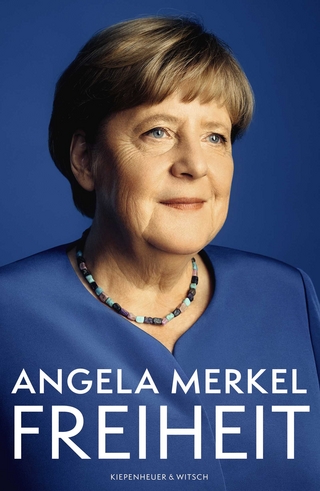

Jorge Atria is Postdoctoral Researcher at Pontificia Universidad Católica de Chile.Constantin Groll is Postdoctoral Researcher at Freie Universität Berlin, Germany.Maria Fernanda Valdés is an independent consultant and program coordinator for the Friedrich Ebert Stiftung in Bogotá, Colombia.

1. Introduction: Taxation in Times of Uncertainty in Latin America .- 2. Debtor Coalitions and Weak Tax Institutions in Latin America: Insights from Argentina and Brazil .- 3. State Capacity and Development: Federalism and Tax in Brazil .- 4. Global Uncertainty in the Evolution of Latin American Income Taxes .- 5. International Insertion, Volatility and Fiscal Resources in Countries Specialized in Extractive Industries: Between A Rock and A Hard Place? .- 6. Gender Bias of Regressive Taxation in Latin America: Overview and Exploration of the Argentinean Case .- 7. Business Groups, Tax Efficiency, and Regressivity in Colombia .- 8. Tax Incentives in Latin America: The Case of Guatemala .- 9. Latin American Taxation from A New Perspective: Contributions from the Relational, Historical and Transnational Dimensions.

| Erscheinungsdatum | 27.12.2017 |

|---|---|

| Reihe/Serie | Latin American Political Economy |

| Zusatzinfo | XVII, 269 p. 9 illus., 5 illus. in color. |

| Verlagsort | Cham |

| Sprache | englisch |

| Maße | 148 x 210 mm |

| Gewicht | 484 g |

| Themenwelt | Sozialwissenschaften ► Politik / Verwaltung ► Politische Systeme |

| Sozialwissenschaften ► Politik / Verwaltung ► Vergleichende Politikwissenschaften | |

| Schlagworte | Debtor Coalitions and Weak Tax Institutions • Development Studies • Economic Policy • Financial Law/Fiscal Law • Financial law: general • Fiscal Policy • Gender bias of regressive taxation • Latin America • Latin American Income Taxes • LATIN AMERICAN POLITICS • Political Economy • Political Science and International Studies • politics & government • Politics & government • public administration • Public Policy • South & Central America (including Mexico), Latin • South & Central America (including Mexico), Latin • Taxation • Tax Reforms • Tax regimes and fiscal policy in Latin America • Tax Systems |

| ISBN-10 | 3-319-60118-0 / 3319601180 |

| ISBN-13 | 978-3-319-60118-2 / 9783319601182 |

| Zustand | Neuware |

| Informationen gemäß Produktsicherheitsverordnung (GPSR) | |

| Haben Sie eine Frage zum Produkt? |

aus dem Bereich