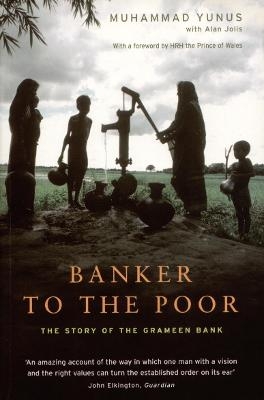

Banker to the Poor

The Story of the Grameen Bank

Seiten

2003

Aurum (Verlag)

978-1-85410-924-8 (ISBN)

Aurum (Verlag)

978-1-85410-924-8 (ISBN)

- Titel ist leider vergriffen;

keine Neuauflage - Artikel merken

The personal story of the man who founded the system of "micro-credit", "Banker to the Poor" tells the story of how he did it. Today Yunus's system of micro-credit is practiced in some 60 countries, including the US, Canada and France and his Grameen Bank is now a billion-pound business.

Muhammad Yunus set up the Grameen Bank in his home country of Bangladesh with a loan of just [pound]17, to lend tiny amounts of money to the poorest of the poor - those to whom no ordinary bank would lend. Most of his customers - as they still are - were illiterate women, wanting to set up the smallest imaginable village enterprises. It was his conviction that this new system of 'micro-credit', lending even such small sums, would give such people the spark of initiative needed to pull themselves out of poverty. Today, Yunus's system of micro-credit is practised around the world in some 60 countries, including the US, Canada and France. His Grameen Bank is now a billion-pound business. It is acknowledged by world leaders and by the World Bank to be a fundamental weapon in the fight against poverty. Banker to the Poor is Yunus's enthralling story of how he did it: how the terrible famine in Bangladesh in 1974 focused his ideas on the need to enable its victims to grow more food; how he overcame the sceptics in many governments and among traditional economic thinking; and how he saw his micro-credit extended even outside the Third World into credit unions in the West. Such is the importance of his book that HRH the Prince of Wales has contributed a Foreword in which he hails 'a remarkable man [who] spoke the greatest good sense'.

Muhammad Yunus set up the Grameen Bank in his home country of Bangladesh with a loan of just [pound]17, to lend tiny amounts of money to the poorest of the poor - those to whom no ordinary bank would lend. Most of his customers - as they still are - were illiterate women, wanting to set up the smallest imaginable village enterprises. It was his conviction that this new system of 'micro-credit', lending even such small sums, would give such people the spark of initiative needed to pull themselves out of poverty. Today, Yunus's system of micro-credit is practised around the world in some 60 countries, including the US, Canada and France. His Grameen Bank is now a billion-pound business. It is acknowledged by world leaders and by the World Bank to be a fundamental weapon in the fight against poverty. Banker to the Poor is Yunus's enthralling story of how he did it: how the terrible famine in Bangladesh in 1974 focused his ideas on the need to enable its victims to grow more food; how he overcame the sceptics in many governments and among traditional economic thinking; and how he saw his micro-credit extended even outside the Third World into credit unions in the West. Such is the importance of his book that HRH the Prince of Wales has contributed a Foreword in which he hails 'a remarkable man [who] spoke the greatest good sense'.

Muhammad Yunus was born in 1940 in Chittagong, now in Bangladesh. In 1997 he led the world's first Micro-Credit Summit in Washington DC.

| Erscheint lt. Verlag | 11.7.2003 |

|---|---|

| Sprache | englisch |

| Maße | 129 x 197 mm |

| Themenwelt | Literatur ► Biografien / Erfahrungsberichte |

| Sachbuch/Ratgeber ► Beruf / Finanzen / Recht / Wirtschaft ► Wirtschaft | |

| Wirtschaft ► Betriebswirtschaft / Management ► Finanzierung | |

| Betriebswirtschaft / Management ► Spezielle Betriebswirtschaftslehre ► Bankbetriebslehre | |

| ISBN-10 | 1-85410-924-3 / 1854109243 |

| ISBN-13 | 978-1-85410-924-8 / 9781854109248 |

| Zustand | Neuware |

| Haben Sie eine Frage zum Produkt? |

Mehr entdecken

aus dem Bereich

aus dem Bereich

warum unser Geld stirbt und wie Sie davon profitieren

Buch | Hardcover (2024)

FinanzBuch (Verlag)

CHF 41,95

denken und handeln wie ein professioneller Trader

Buch | Softcover (2023)

Vahlen, Franz (Verlag)

CHF 51,65