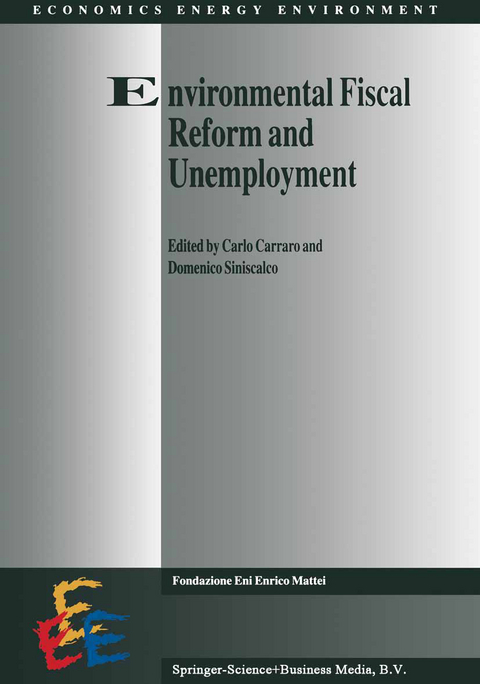

Environmental Fiscal Reform and Unemployment

Springer (Verlag)

978-90-481-4622-2 (ISBN)

The European Union faces several interlinked challenges: how to protect the environment and favour sustainability; how to reduce unemployment and foster competitiveness in a context of growing globalization; how to reduce regional disparities among and within me mb er countries. The recent policy debate has clarified that the above objectives are not a trade off if jointly tackled. In particular, win-win policy options are available to the European Union by an appropriate integration of regulation, macro policy, social policy, fiscal policy and environmental policy. Evidence shows that optimising on each single policy will not meet the needs of the European Union. On the contrary, an integrated approach will make it possible to reach the various objectives, as stated in the Treaty on European Union, in the 5th Environmental Action Programme, in the White Paper on Growth, Competitiveness and Employment. This integrated approach would im plement a genuine sustainable development policy.

I: Theoretical Approaches to Environmental Fiscal Reforms.- 1. Environmental Taxation and the Double-Dividend: The Role of Factor Substitution and Capital Mobility.- 2. Shifting Taxes from Value Added to Material Inputs.- 3. Environmental Taxation and Employment in a Multi-Sector General Equilibrium Model.- 4. Optimal Government Policy, the Environment, Employment, and Tax Shifting.- 5. Environmental Policy, Worker Moral Hazard and the Double Dividend Issue.- II: Empirical Assessment of Environmental Fiscal Reforms.- 6. Labour Market Institutions and the Double Dividend Hypothesis. An Application of the Warm Model.- 7. The Double Dividend Hypothesis, the Environmental Benefits and the International Coordination of Tax Recycling.- 8. Double Dividend Analysis: First Results of a General Equilibrium Model (GEM-E3) Linking the EU-12 Countries.- 9. Employment, Wage Formation and Pricing in the European Union: Empirical Modelling of Environmental Tax Reform.

| Erscheint lt. Verlag | 15.12.2010 |

|---|---|

| Reihe/Serie | Economics, Energy and Environment ; 7 |

| Zusatzinfo | XVII, 272 p. |

| Verlagsort | Dordrecht |

| Sprache | englisch |

| Maße | 170 x 244 mm |

| Themenwelt | Sachbuch/Ratgeber ► Natur / Technik ► Natur / Ökologie |

| Naturwissenschaften ► Biologie ► Ökologie / Naturschutz | |

| Naturwissenschaften ► Geowissenschaften | |

| Technik | |

| Wirtschaft ► Volkswirtschaftslehre ► Makroökonomie | |

| ISBN-10 | 90-481-4622-4 / 9048146224 |

| ISBN-13 | 978-90-481-4622-2 / 9789048146222 |

| Zustand | Neuware |

| Haben Sie eine Frage zum Produkt? |

aus dem Bereich