European Union: Tax Treaties of the Central and Eastern European Countries

Seiten

2008

|

2008

Linde Verlag Ges.m.b.H.

978-3-7073-1223-2 (ISBN)

Linde Verlag Ges.m.b.H.

978-3-7073-1223-2 (ISBN)

- Titel ist leider vergriffen;

keine Neuauflage - Artikel merken

lt;p>The First Comprehensive Analysis of the Tax Treaty Policies of the CEE Countries

After 1989-90 major political and economic changes took place in the Central and Eastern European countries. This publication provides the first comprehensive analysis of the tax treaty policies of Bulgaria, the Czech Republic, Estonia, Hungary, Latvia, Lithuania, Poland, Romania, Slovakia and Slovenia along with the trends over time.

Further, this book goes into detail on the bilateral tax treaty provisions of these countries and in particular the deviations from the OECD Model Convention and offers a perspective on developments that can be expected in the tax treaty area.

Practitioners will find a lot of detailed information on the tax treaties of these countries.

After 1989-90 major political and economic changes took place in the Central and Eastern European countries. This publication provides the first comprehensive analysis of the tax treaty policies of Bulgaria, the Czech Republic, Estonia, Hungary, Latvia, Lithuania, Poland, Romania, Slovakia and Slovenia along with the trends over time.

Further, this book goes into detail on the bilateral tax treaty provisions of these countries and in particular the deviations from the OECD Model Convention and offers a perspective on developments that can be expected in the tax treaty area.

Practitioners will find a lot of detailed information on the tax treaties of these countries.

ist Vorstand des Instituts für Österreichisches und Internationales Steuerrecht, Wissenschaftlicher Leiter des LL.M.-Studiums International Tax Law sowie Sprecher des Doktorandenkollegs „Doctoral Program in International Business Taxation (DIBT)“ der WU.

UniCredit Group, Executive Vice President, Tax Affairs.

Bocconi Universität, Abteilung für Rechtswissenschaft.

Steuerabteilung der Bank Austria.

| Erscheint lt. Verlag | 1.9.2008 |

|---|---|

| Sprache | englisch |

| Maße | 155 x 225 mm |

| Gewicht | 347 g |

| Einbandart | kartoniert |

| Themenwelt | Recht / Steuern ► Steuern / Steuerrecht ► Internationales Steuerrecht |

| Schlagworte | CEE • Doppelbesteuerung • double taxation • EU-Recht • Europarecht • Europarecht (EuR) • HC/Recht/Steuern • Internationales Steuerrecht • Tax Treaties CEE • Tax Treaty Policy |

| ISBN-10 | 3-7073-1223-2 / 3707312232 |

| ISBN-13 | 978-3-7073-1223-2 / 9783707312232 |

| Zustand | Neuware |

| Haben Sie eine Frage zum Produkt? |

Mehr entdecken

aus dem Bereich

aus dem Bereich

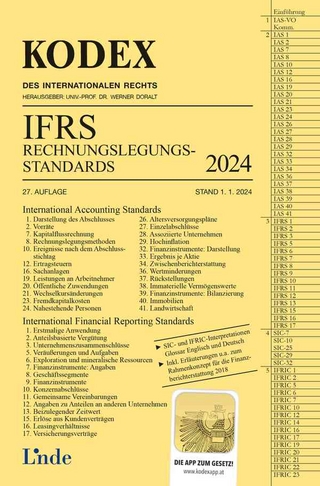

deutsche Investitionen im Ausland - ausländische Investitionen im …

Buch | Hardcover (2023)

C.H.Beck (Verlag)

CHF 236,55

Buch | Softcover (2024)

Linde Verlag Ges.m.b.H.

CHF 47,60