GAARs and Judicial Anti-Avoidance in Germany, the UK and the EU

Series on International Tax Law, Volume 98

Seiten

2016

|

1. Auflage 2016

Linde Verlag Ges.m.b.H.

978-3-7073-3515-6 (ISBN)

Linde Verlag Ges.m.b.H.

978-3-7073-3515-6 (ISBN)

- Titel ist leider vergriffen;

keine Neuauflage - Artikel merken

In a post-BEPS tax world and in times of an ever-increasing need for tax revenue, policy-makers are more willing than ever to tighten or adopt General Anti-Avoidance Rules (GAARs). A GAAR is typically a broad principle-based rule trying to establish the borderline between "abuse" and "use" of a law, thereby addressing the phenomenon that as long as there have been taxes, persons have been trying to reduce their tax bills.

GAARS: the better insight into a country's tax system

In a post-BEPS tax world and in times of an ever-increasing need for tax revenue, policy-makers are more willing than ever to tighten or adopt General Anti-Avoidance Rules (GAARs). A GAAR is typically a broad principle-based rule trying to establish the borderline between "abuse" and "use" of a law, thereby addressing the phenomenon that as long as there have been taxes, persons have been trying to reduce their tax bills.

This award-winning book compares the GAARs and judicial anti-avoidance approaches of Germany, the UK and the EU. It gives a deep insight into the predominant legal traditions of the Western World, comprehensively analyses case-law and offers unique perspectives on tax law across jurisdictions. This book reveals that there is no other feature of tax law that provides a better insight into a country's tax system than its anti-avoidance rules. GAARs and their historical background reveal so much about judicial perspectives on taxation and legal interpretation, citizens' tax morale, drafters' inclinations for technical or principled drafting or legislators' willingness to confront politically sensitive issues. Understanding the role of GAARs ultimately also reveals whether they are a suitable means to counteract tax avoidance effectively.

The Book is the winner of the Wolfgang Gassner-Wissenschaftspreis 2016!

GAARS: the better insight into a country's tax system

In a post-BEPS tax world and in times of an ever-increasing need for tax revenue, policy-makers are more willing than ever to tighten or adopt General Anti-Avoidance Rules (GAARs). A GAAR is typically a broad principle-based rule trying to establish the borderline between "abuse" and "use" of a law, thereby addressing the phenomenon that as long as there have been taxes, persons have been trying to reduce their tax bills.

This award-winning book compares the GAARs and judicial anti-avoidance approaches of Germany, the UK and the EU. It gives a deep insight into the predominant legal traditions of the Western World, comprehensively analyses case-law and offers unique perspectives on tax law across jurisdictions. This book reveals that there is no other feature of tax law that provides a better insight into a country's tax system than its anti-avoidance rules. GAARs and their historical background reveal so much about judicial perspectives on taxation and legal interpretation, citizens' tax morale, drafters' inclinations for technical or principled drafting or legislators' willingness to confront politically sensitive issues. Understanding the role of GAARs ultimately also reveals whether they are a suitable means to counteract tax avoidance effectively.

The Book is the winner of the Wolfgang Gassner-Wissenschaftspreis 2016!

Steuerberater und Head of Group Tax bei Mayr-Melnhof. Zuvor verantwortlich für Europa für einen US-börsennotierten Konzern und tätig als Steuerberater in einem renommierten internationalen Steuerberatungsunternehmen. Fachvortragender, Fachautor und Universitätslektor auf der WU Wien.

| Erscheinungsdatum | 06.07.2016 |

|---|---|

| Reihe/Serie | Schriftenreihe zum Internationalen Steuerrecht ; 98 |

| Sprache | englisch |

| Maße | 155 x 225 mm |

| Gewicht | 615 g |

| Einbandart | kartoniert |

| Themenwelt | Recht / Steuern ► Steuern / Steuerrecht ► Internationales Steuerrecht |

| Schlagworte | Internationales Steuerrecht • Steuerbetrug • Steuerhinterziehung |

| ISBN-10 | 3-7073-3515-1 / 3707335151 |

| ISBN-13 | 978-3-7073-3515-6 / 9783707335156 |

| Zustand | Neuware |

| Haben Sie eine Frage zum Produkt? |

Mehr entdecken

aus dem Bereich

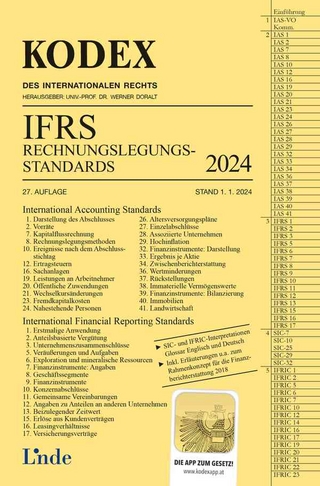

aus dem Bereich

deutsche Investitionen im Ausland - ausländische Investitionen im …

Buch | Hardcover (2023)

C.H.Beck (Verlag)

CHF 236,55

Buch | Softcover (2024)

Linde Verlag Ges.m.b.H.

CHF 47,60