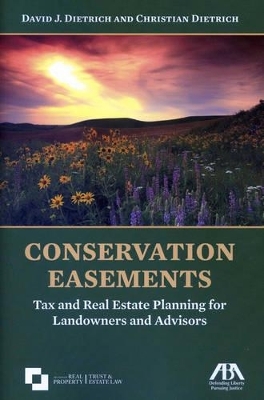

Conservation Easements

American Bar Association

978-1-61438-113-6 (ISBN)

Appendices are also provided on an accompanying CD-ROM.

David Dietrich was born in Billings, Montana and practices in tax, real estate, and agricultural law with Dietrich & Associates, P.C., in Billings. He is a frequent speaker at estate planning and real estate conferences and has been active with civic organizations including the Montana Land Reliance, a leading conservation land trust. Christian Dietrich attended the University of Montana School of Law, graduating with honors in 2009. While at law school, he served as a legal intern at the Rocky Mountain Elk Foundation, working extensively on conservation easement issues. He has since focused on business, real estate, tax, and nonprofit law. He has served on the boards of several local nonprofit organizations and advises local and national nonprofits. He lives in Helena, Montana.

| Erscheint lt. Verlag | 6.9.2013 |

|---|---|

| Verlagsort | Chicago, IL |

| Sprache | englisch |

| Maße | 155 x 227 mm |

| Gewicht | 599 g |

| Themenwelt | Recht / Steuern ► EU / Internationales Recht |

| Recht / Steuern ► Öffentliches Recht ► Umweltrecht | |

| Recht / Steuern ► Privatrecht / Bürgerliches Recht ► Sachenrecht | |

| Recht / Steuern ► Wirtschaftsrecht ► Gesellschaftsrecht | |

| ISBN-10 | 1-61438-113-5 / 1614381135 |

| ISBN-13 | 978-1-61438-113-6 / 9781614381136 |

| Zustand | Neuware |

| Haben Sie eine Frage zum Produkt? |

aus dem Bereich