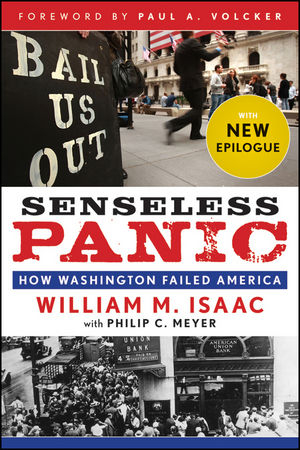

Senseless Panic

John Wiley & Sons Inc (Verlag)

978-1-118-43198-6 (ISBN)

The truth about the 2008 economic crisis from a Washington insider The 1980s opened with the prime interest rate at an astonishing 21.5 percent, leading to a severe recession with unemployment reaching nearly 11 percent. Depression-like conditions befell the country, the entire thrift industry was badly insolvent and the major money center banks were loaded with third world debt. Some 3,000 bank and thrifts failed, including nine of Texas’ ten largest, and Continental Illinois, which, at the time, was the seventh largest bank in the nation. These severe conditions were not only handled without creating a panic, the economy actually embarked on the longest peacetime expansion in history.

In Senseless Panic: How Washington Failed America, William M. Isaac, Chairman of the Federal Deposit Insurance Corporation (FDIC) during the banking and S&L crises of the 1980s, details what was different about 2008’s meltdown that allowed the failure of a comparative handful of institutions to nearly shut down the world’s financial system. The book also tells the rousing story of Isaac’s time at the FDIC.

Details the mistakes that led to the panic of 2008 and 2009

An updated paperback revision of the bestselling book on the 2008 economic crisis, including a fascinating new Epilogue

Demystifies the conditions America faced in 2008

Provides a road map for avoiding similar shutdowns and panics in the future

Includes a foreword by Federal Reserve Chairman Paul Volcker

Senseless Panic is a provocative, quick-paced, and thoughtful analysis of what went wrong with the nation's banking system, a blunt indictment of United States policy, and a road map for making sure it doesn’t happen again.

William M. Isaac is Senior Managing Director and Global Head of Financial Institutions for FTI Consulting and Chairman of Fifth Third Bancorp. Both are positions he assumed after this book was published in its hardcover edition. He served as Chairman of the Federal Deposit Insurance Corporation during the banking and S&L crises of the 1980s, when some 3,000 banks and thrifts failed, including nine of the ten largest Texas banks as well as Continental Illinois, then the nation's seventh largest bank. Isaac writes frequently for the Wall Street Journal, Financial Times, Forbes, Washington Times, Washington Post, New York Times, American Banker, and other leading publications; testifies before Congress; and makes regular appearances on leading radio and television programs.

Foreword ix Acknowledgments xiii

Introduction xv

Part One: No Calm Before the Storm 1

Chapter 1 Home Alone 3

Chapter 2 The Early Years (1978 –1981) 13

Chapter 3 The Savings Bank and S&L Crises 22

Chapter 4 Penn Square Fails 29

Chapter 5 The Butcher Empire Collapses 47

Chapter 6 Deposit Insurance Reform/Tackling Wall Street 53

Chapter 7 Continental Illinois Topples 64

Chapter 8 Preparing to Leave 86

Chapter 9 Lessons Learned 92

Part Two: Here We Go Again 99

Chapter 10 Policy Mistakes—1989 through 2007 101

Chapter 11 The Subprime Mortgage Problem 113

Chapter 12 SEC and FASB Blunders 118

Chapter 13 Schizophrenic Failure Resolution 131

Chapter 14 The $700 Billion Bailout 148

Chapter 15 Never Again 161

Afterword 177

Epilogue 180

Authors’ Notes on Sources 208

About the Authors 209

Index 211

| Erscheint lt. Verlag | 10.8.2012 |

|---|---|

| Co-Autor | Philip C. Meyer |

| Vorwort | Paul A. Volcker |

| Verlagsort | New York |

| Sprache | englisch |

| Maße | 155 x 231 mm |

| Gewicht | 299 g |

| Themenwelt | Geschichte ► Teilgebiete der Geschichte ► Wirtschaftsgeschichte |

| Wirtschaft ► Betriebswirtschaft / Management ► Finanzierung | |

| Betriebswirtschaft / Management ► Spezielle Betriebswirtschaftslehre ► Bankbetriebslehre | |

| ISBN-10 | 1-118-43198-7 / 1118431987 |

| ISBN-13 | 978-1-118-43198-6 / 9781118431986 |

| Zustand | Neuware |

| Haben Sie eine Frage zum Produkt? |

aus dem Bereich