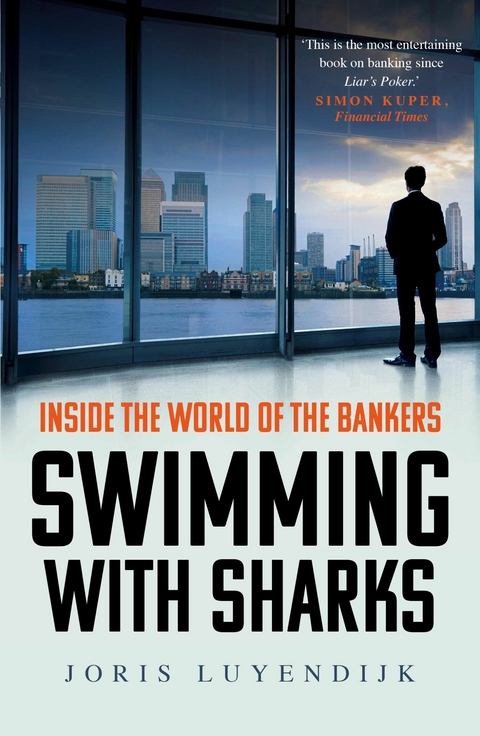

Swimming with Sharks (eBook)

352 Seiten

Guardian Faber Publishing (Verlag)

978-1-78335-066-7 (ISBN)

Joris Luyendijk was born in Amsterdam. He is a writer, journalist and author of Hello Everybody!: One Journalist's Search for Truth in the Middle East.In 2011 Luyendijk was as ignorant of a 'CDO' or any other maddening financial acronym as you or I. The Guardian asked him to look at the world of finance from a beginner's perspective and chart his learnings - the hugely popular Banking Blog was the result of this investigation. Follow him on @JLbankingblog.

Joris Luyendijk, an investigative journalist, knew as much about banking as the average person: almost nothing. Bankers, he thought, were ruthless, competitive, bonus-obsessed sharks, irrelevant to his life. And then he was assigned to investigate the financial sector. Joris immersed himself in the City for a few years, speaking to over 200 people - from the competitive investment bankers and elite hedge-fund managers to downtrodden back-office staff, reviled HR managers and those made redundant in the regular 'culls'. Breaking the strictly imposed code of secrecy and silence, these insiders talked to Joris about what they actually do all day, how they see themselves and what makes them tick. They opened up about the toxic hiring and firing culture. They confessed to being overwhelmed by technological and mathematical opacity. They admitted that when Lehman Brothers went down in 2008 they hoarded food, put their money in gold and prepared to evacuate their children to the countryside. They agreed that nothing has changed since the crash. Joris had a chilling realisation. What if the bankers themselves aren't the real enemy? What if the truth about global finance is more sinister than that?This is a gripping work of reportage about the time bomb at the heart of our society.

An exploration of the inner workings of banking that's both enormously entertaining and utterly terrifying. Proceeding in his fair-minded, unsensationalist way, Joris Luyendijk ends up showing how the financial system has evolved to offer all the wrong psychological rewards for all the worst behaviour - and how we may be teetering on the brink of a greater crisis than those we've already seen. It's not (mainly) that bankers are bad people. It's far scarier than that.

Joris Luyendijk dives deep into the most important social pocket in the world: among the elite financiers who nearly killed the world economy a few years ago - and who are right now carrying on as before in a system that's as shaky as ever. All this is described not with spleen, but with an attentive empathy - and the book is all the more terrifying for it.

When looking into the pros and cons of the electric car I had started from zero, without doing any research. Adopting a beginner’s outlook had forced insiders to use simple language and I figured I’d try that approach again for this project.

Now I just needed that beginner’s question. I asked friends and acquaintances in Amsterdam and London what they wanted to know about the world of finance. Almost everyone I spoke to was angry without being able to explain exactly why. Nobody seemed to understand what had actually happened during the collapse of the American bank Lehman Brothers in 2008 or the ensuing crash, the biggest financial panic since the 1930s. I kept hearing, ‘If you can help me understand how it works in finance then I’ll be grateful. But I know that within two days I will have forgotten all that technical stuff again.’

All right, I would respond. Is there a question about finance or bankers that occupies you so much that you would remember the answer? These were difficult conversations because people needed to vent their outrage first. ‘Isn’t it incredible’, they would say, ‘that we had to bail out these bankers and yet none of them have had to pay back their bonuses? Look at how the cuts hit the most vulnerable in society. Meanwhile bankers give themselves huge bonuses, even at banks that exist only because we saved them.’ Eventually it occurred to me that my friends were asking the same thing: ‘How can these people live with themselves?’ That seemed a good start – phrased a bit more subtly, perhaps.

As soon as I had settled in London I got out my address book and approached everyone I knew, asking them to introduce me to someone who worked in the City. Responses would take a while to come in, of course, giving me a chance to explore my new home in the meantime. I had always thought of London in the same category as Berlin and Paris: the capital of a big European country. But London is the size of Berlin, Madrid and Paris put together.

I took the tube into the centre of town and went for a walk. Now I could begin to see for myself that ‘the City’ as a term is no longer accurate. The financial sector in London employs between 250,000 and 300,000 people. That’s a lot of jobs and they have begun to spread across the capital. To the west near Piccadilly Circus lies the well-heeled and discreet area of Mayfair, where you’ll find the more adventurous types of professional investors of other people’s money: private equity and hedge funds as well as venture capitalists. Then there is the historical ‘City’ or ‘Square Mile’ near Bank tube station, where many brokerage firms, the insurance sector and a number of big banks such as Goldman Sachs are surrounded by architectural icons such as St Paul’s Cathedral, the Bank of England and the illustrious former Stock Exchange (now a restaurant and shopping centre). Moving east towards City Airport you reach Canary Wharf, a former harbour where increasing numbers of banks and financial institutions have their headquarters. Canary Wharf is made up of seductively shiny glass skyscrapers and a huge shopping centre, fringed by manicured greenery, each corner observed by the constant gaze of CCTV cameras. The area is privately owned and privately controlled, as any campaigners who gather to protest are swiftly informed – every piece of land on Canary Wharf apart from the 50 yards outside the Jubilee Line station is private.

Several days passed while I continued my wanders around the city. I hadn’t had a single response to my request for introductions to financial insiders. I was beginning to worry when a friend I knew from Jerusalem invited me to a party where he introduced me to ‘Sid’. Sid was in his late thirties, tall and broad-shouldered, the son of immigrants. After a career as a trader with a number of major banks he had joined a few colleagues to start a brokerage firm: a company that buys and sells products in the markets on behalf of clients for a commission. Helping outsiders understand the City was ‘more than overdue’, Sid said in a welcoming voice. Why didn’t I come over and spend a day at his firm? The only condition was that I could not identify him or his company by name. ‘Clients wouldn’t understand us talking to the press.’

A week later, soon after daybreak, I arrived at Sid’s firm on a busy street in the historical heart of the City. Sid had already told me that there is a clear divide in the world of finance between those who see their children in the morning and those who see them in the evening. The ones who work in tandem with ‘the markets’ have to get up really, really early to be ready to go when the markets open. They see their children in the evening. The other part of the financial world works independently of the markets, for instance lawyers and dealmakers in mergers and acquisitions. They can take their children to nursery or school, but work late pretty much every evening. When you see financial workers having lunch somewhere in the City, it’s always this second category. People who work with the markets have their lunches next to their computer screens.

‘Why don’t you find something to do for a moment?’ Sid suggested. ‘I need to finish my note to investors before half seven.’ He walked over to his desk where an impressive array of computer screens showed news tickers, graphs and market data. Everywhere I looked there were telephones and TVs switched to the financial news channels. There was less than an hour to go before the markets opened; an atmosphere of concentrated anticipation filled the room. My stomach tensed like it does before a crucial World Cup game.

Sid explained that his note consisted of analysis and investment advice for his clients: mostly pension funds, insurance companies and other professional investors of other people’s money. He estimated that his clients received at least 300 such emails each day. ‘I try to be short and to the point – clients’ attention span will never exceed a page. The best you can hope for is that they read a few paragraphs.’ In his notes he did not make statements on individual companies – there were whole teams of researchers for that elsewhere, he said. Instead he went for what he described as ‘the bird’s-eye view of the entire economy’. For the rest of the day he offered commentary on new developments and updated his note.

Was he like a sports commentator, with the markets being the match? He thought for a moment. ‘Maybe, except my analysis is directed at the coaches and players in the field, rather than the audience in the stadium.’ Among his clients were also traders at major banks. ‘All of us here have worked at big banks, so we know what it’s like there. It can be a pretty lonely life as a trader. You have specialised in one particular area, say the automobile industry. That’s your “book”. But there may be only one of you with that book. Maybe there’s a junior helping you out, but that’s it. Our research is like a sounding board for clients, a second opinion. We pass out good ideas but also nuggets of insight that they can use to look good in front of their boss.’

The markets opened and for half an hour everybody seemed extremely busy. Brokers were shouting to each other across the floor: ‘Did you see gold at 1670?’ As things were settling down, a broker whose job it was to ‘go into’ the market and find a buyer for what her clients wanted to sell and vice versa kept one eye on the Sun and the other on her screens. ‘What’s the difference between a broker and his client?’ she asked me. ‘A broker says “fuck you” only after hanging up the phone.’

I wrote it down in my notebook and went over to a man in his late twenties with his fingertips against his temples. He was staring at four screens and leaning in so close his nose nearly touched one of them. He explained that he was doing ‘technical analysis’. Simplified: he was looking for trends in the share price of a particular set of companies, and gave investment advice on that basis. The markets had captivated him from secondary school onwards. He didn’t understand much about economics and he quickly learned that only the big players can pay for the sophisticated and high-value research like Sid’s. Then he discovered ‘technical analysis’, a way of working with public data to study the market. ‘I have been doing this for quite a few years now,’ he said, ‘and it’s surprisingly often about intuition, the unconscious recognition and spotting of patterns.’

‘Hey, you,’ Sid called out mock-sternly. ‘You go talk to our Dutch guest.’ And so I sat down with a well-spoken and slightly haggard-looking man in his late twenties. He told me that as a sales guy he considered himself lucky. He only had to get up at 5.30 a.m. whereas people like Sid rose at five. I was taking everything down as fast as I could in my little notebook when the Sun-reading broker passed me a folded piece of paper that said: ‘Seriously deranged but harmless – most of the time.’ With a smile, the sales guy crunched it up and threw it at the broker’s head. He shrugged: ‘Trading-floor humour.’

His job as ‘sales guy’ was to take the analysis from Sid or the technical analyst to his own body of clients in the hope of getting them to buy or sell something through his brokerage. He was a kind of filter, he explained, because he knew his clients’ needs very well. Some focused on the psychology of the market of the day and preferred to read technical analysis, others looked at long-term and ‘fundamental’ aspects such as the...

| Erscheint lt. Verlag | 15.9.2015 |

|---|---|

| Verlagsort | London |

| Sprache | englisch |

| Themenwelt | Sachbuch/Ratgeber ► Geschichte / Politik ► Politik / Gesellschaft |

| Geschichte ► Teilgebiete der Geschichte ► Kulturgeschichte | |

| Recht / Steuern ► Wirtschaftsrecht | |

| Wirtschaft ► Betriebswirtschaft / Management ► Finanzierung | |

| Betriebswirtschaft / Management ► Spezielle Betriebswirtschaftslehre ► Bankbetriebslehre | |

| Wirtschaft ► Volkswirtschaftslehre | |

| Schlagworte | bankers bonus • Banking Crisis • City of London • evil bankers • Financial Crisis • greedy bankers • Watching the English |

| ISBN-10 | 1-78335-066-0 / 1783350660 |

| ISBN-13 | 978-1-78335-066-7 / 9781783350667 |

| Haben Sie eine Frage zum Produkt? |

Größe: 337 KB

DRM: Digitales Wasserzeichen

Dieses eBook enthält ein digitales Wasserzeichen und ist damit für Sie personalisiert. Bei einer missbräuchlichen Weitergabe des eBooks an Dritte ist eine Rückverfolgung an die Quelle möglich.

Dateiformat: EPUB (Electronic Publication)

EPUB ist ein offener Standard für eBooks und eignet sich besonders zur Darstellung von Belletristik und Sachbüchern. Der Fließtext wird dynamisch an die Display- und Schriftgröße angepasst. Auch für mobile Lesegeräte ist EPUB daher gut geeignet.

Systemvoraussetzungen:

PC/Mac: Mit einem PC oder Mac können Sie dieses eBook lesen. Sie benötigen dafür die kostenlose Software Adobe Digital Editions.

eReader: Dieses eBook kann mit (fast) allen eBook-Readern gelesen werden. Mit dem amazon-Kindle ist es aber nicht kompatibel.

Smartphone/Tablet: Egal ob Apple oder Android, dieses eBook können Sie lesen. Sie benötigen dafür eine kostenlose App.

Geräteliste und zusätzliche Hinweise

Buying eBooks from abroad

For tax law reasons we can sell eBooks just within Germany and Switzerland. Regrettably we cannot fulfill eBook-orders from other countries.

Kopierschutz: Adobe-DRM

Adobe-DRM ist ein Kopierschutz, der das eBook vor Mißbrauch schützen soll. Dabei wird das eBook bereits beim Download auf Ihre persönliche Adobe-ID autorisiert. Lesen können Sie das eBook dann nur auf den Geräten, welche ebenfalls auf Ihre Adobe-ID registriert sind.

Details zum Adobe-DRM

Dateiformat: EPUB (Electronic Publication)

EPUB ist ein offener Standard für eBooks und eignet sich besonders zur Darstellung von Belletristik und Sachbüchern. Der Fließtext wird dynamisch an die Display- und Schriftgröße angepasst. Auch für mobile Lesegeräte ist EPUB daher gut geeignet.

Systemvoraussetzungen:

PC/Mac: Mit einem PC oder Mac können Sie dieses eBook lesen. Sie benötigen eine

eReader: Dieses eBook kann mit (fast) allen eBook-Readern gelesen werden. Mit dem amazon-Kindle ist es aber nicht kompatibel.

Smartphone/Tablet: Egal ob Apple oder Android, dieses eBook können Sie lesen. Sie benötigen eine

Geräteliste und zusätzliche Hinweise

Buying eBooks from abroad

For tax law reasons we can sell eBooks just within Germany and Switzerland. Regrettably we cannot fulfill eBook-orders from other countries.

aus dem Bereich